Are You Ready To Buy A Home?

Here are four financial fixes to make before buying a home.

Becoming a homeowner means making what’s probably the largest purchase of your life to date. It’s an enormous financial obligation, and if things don’t go according to plan, your finances can be significantly affected for a long time.

When it comes to your household’s finances, there are some things to get in order. Both to be certain you’re ready to become a first-time homebuyer and to make it as affordable as possible. Here are four financial fixes to make before buying a home.

Straighten out your credit

Your credit history has a huge impact on your success (or failure) as a first-time homebuyer. A poor credit score can completely disqualify you from obtaining a mortgage. And better scores can save money by making you eligible for better mortgage interest and insurance rates.

If you’re even thinking of becoming a homeowner, it’s important to request a copy of your credit report. Examine it for errors and old derogatory entries, and contact the creditors to request they be removed. Also, look at your history of late payments. Where can you improve? The simplest way to improve a credit score is to pay down debt and make all your payments on time.

Develop a monthly budget

Everybody says they have a budget, but not everybody actually does. If you’re thinking of becoming a homeowner, you should probably sit down with your favorite spreadsheet software and come up with a true budget.

If you feel like you don’t know where your money goes, it’s probably because you don’t have a budget. Making one involves tracking every dollar you earn and allocating it to something. Your income should be earmarked for housing costs, food, clothing, transportation, long-term debt, entertainment, savings and whatever else you can think of.

You don’t want to take on a house payment – probably your biggest monthly expense – without knowing how much you spend on everything else.

If you're thinking of becoming a homeowner, it's a good idea to explore some financial fixes first.

Determine what you can and can’t afford

A mortgage lender will tell you that you qualify for a house payment that’s no higher than 28 percent of your gross monthly income and will also require that your total monthly debt payments are no more than 35 percent of your monthly gross. Really, though, only you know how much you can truly afford.

What if you get a mortgage that’s at the 28-percent threshold but makes your finances tight nonetheless? If you have to eat out less often or cut down on some subscriptions in order to save money, can you do it?

If your rent is, say, $1,000 a month and you find that money is still scarce, how will you make the $1,200 house payment that your bank says you can afford? You must know what you are comfortable spending on a house and know what other things you can cut back on if necessary.

Start saving

Some would-be homebuyers are forced to delay homeownership because they don’t have enough money for a down payment. Most first-time homebuyer loans will require at least 5 percent of the purchase price down, and it takes 20 percent to avoid paying private mortgage insurance and to get a lower interest rate. But it’s not just down payment funds you should be saving.

It makes financial sense to have a “rainy day” or emergency savings account, too. Large unexpected expenses can decimate a cash-strapped household. If you spend your entire life savings on a down payment and add the large monthly expense of a mortgage, you run the risk of being house poor. Try to put away at least a little money each paycheck to dull the pain of surprise expenses that might pop up.

The bottom line

Buying a home is a large investment, and some people just aren’t financially ready for it. If you’re thinking of becoming a homeowner, it’s a good idea to explore some financial fixes first.

About the Author:

Paul Adams

Paul authors original Lifestyle, Personal Development, Business & Money articles and compiles information from various resources to create features for VIGOROUS Magazine.

Share this post:

VIGOROUS Magazine – IPL Bikini, Evening Gown Pro & 2X Fitness Angels Pro Champ, Brittney Truman

“When you are confident and comfortable in your own skin, it shows through in every part of your life.”

VIGOROUS Magazine: IPL Pro Katie Acuña’s Exclusive Photoshoot – PART ONE

“I am more shy in front of people than the camera. The camera feels more natural to me.”

VIGOROUS Magazine – IPL Bikini & Evening Gown Pro Megan Roark

“Tattoos? I love them! I have plenty. They are a great way to express yourself.”

SEAM Magazine Q&A With IPL Sports Model & Evening Gown Athlete Jessica Carbajal

“First is to love yourself, and second is to pay attention to your thoughts.”

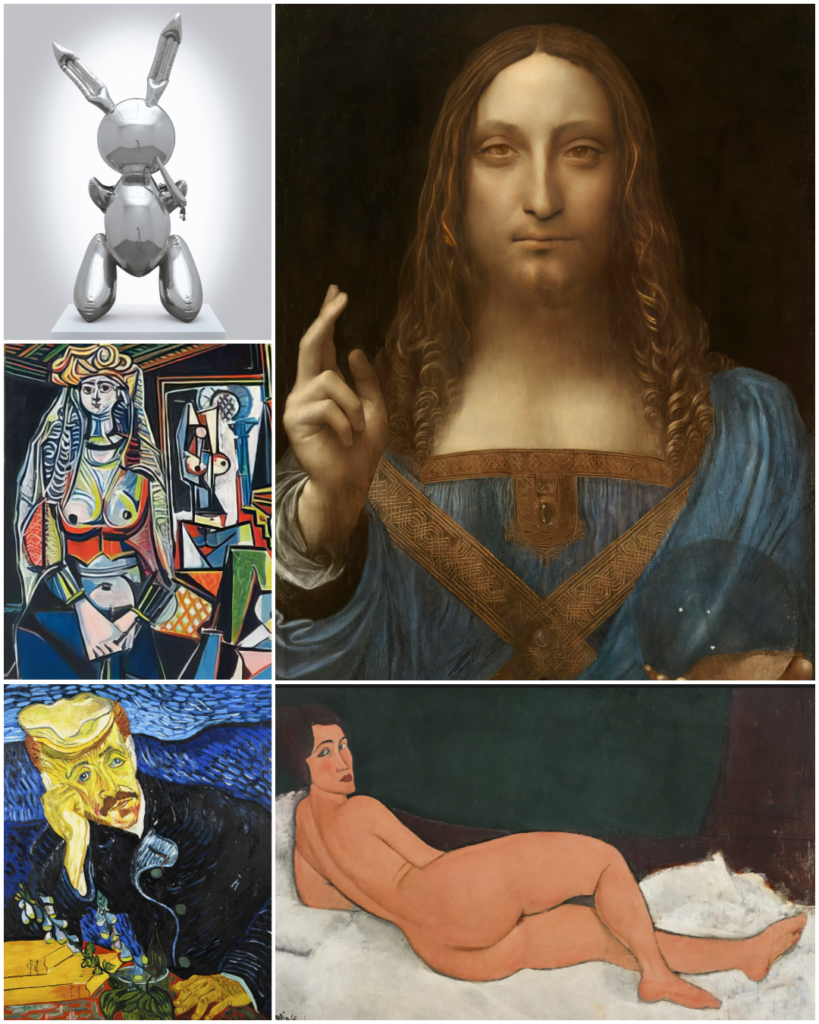

VIGOROUS Magazine: The World’s Most Pricey Art

“From iconic masterpieces to contemporary marvels, artworks have fetched staggering sums at auctions in recent years, reflecting a global fascination with creativity and rarity.”

SEAM Magazine Q&A With IPL Pro Chrissy Jack

“One bad day isn’t a pattern and it doesn’t mean you have fallen off the wagon. Just recognize you are human. Pick yourself up off the floor, put your game face back on and keep going.”